Meeting the Needs of Families with Special Needs

November 7, 2014 | Caregiving, Maintaining Independence, Prevention of Illness and Management of Chronic Conditions

Maximizing the Quality of Life for Families with Special Needs

As the name of our company suggests, most of Elder Care Guides’ clients are older adults who access our professional care management and in-home support services to improve their quality of life and maximize safety while living as independently as their situation allows. But through the years we’ve seen an increase in the number of families caring for a loved one with a developmental disability who come to us for support. Within these aging families, many parents are wondering who will take over the care of their adult child when they themselves are no longer able to do so. Will they have access to the kind of care they would want for their son or daughter?

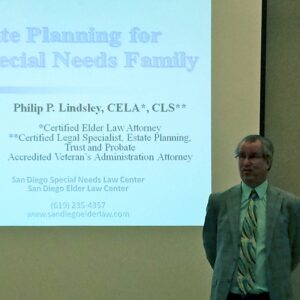

In order to better serve these families, I recently attended a Special Needs Trust presentation by the CELA Certified Elder Law Attorney Phil Lindsley. He has been involved with the special needs community for over 30 years and is the senior attorney at the San Diego Elder Law Center.

Anyone with even a remote knowledge of this area of the law knows that things get complicated very quickly. A lot of important information was covered during his two-hour presentation, and below I’ve provided a brief summary of my key takeaways.

The most common special needs planning mistakes that families make:

- Disinheriting the disabled child, assuming this to be the only way to preserve eligibility for public benefit programs. This is not only inaccurate, but it may also deprive the vulnerable family member of support they need.

- The bequest of money to a sibling with the understanding that he or she will be responsible for all care in the future. This places a heavy burden on the sibling, and there is no guarantee that the money will be used for the care of its intended recipient.

- Procrastination. No one can foresee at what point they may be incapable of providing care, and the family member with special needs will likely not be able to compensate for this failure to plan.

The case for a special needs trust (SNT):

- SNTs preserve public benefit eligibility (for programs like SSI, Medi-Cal, and IHSS), while providing supplemental funds for items which may not be covered but that are important for the quality of life of the recipient, e.g. clothing, furniture, pet supplies and vacations. The trustee decides what is meaningful for the beneficiary, ensuring the money is spent in accordance with their personal values.

- An SNT provides assurance that the right team is in place, which may include family members and/or professionals. This process ensures that everyone involved in the beneficiary’s care is both willing to help, and knowledgeable about how best to help.

- Because assets in a trust are not subject to probate, a trust makes good financial sense. Other forms of trusts, like a Standard Living Trust, do not provide protection of assets from public benefit calculations, making the SNT the trust of choice for a special needs family.

Considering the complexity of these issues, families planning ahead for the care of a family member with special needs require the advice of an attorney with specialized expertise in this field. Below you will find some local and national resources which may be of some help.

National Academy of Elder Law Attorneys, Inc.: http://www.naela.org/

National Elder Law Foundation: http://nelf.org/

Special Needs Trust Foundation of San Diego: http://sntf-sd.org/

San Diego Elder Law Center: http://www.sandiegoelderlaw.com/